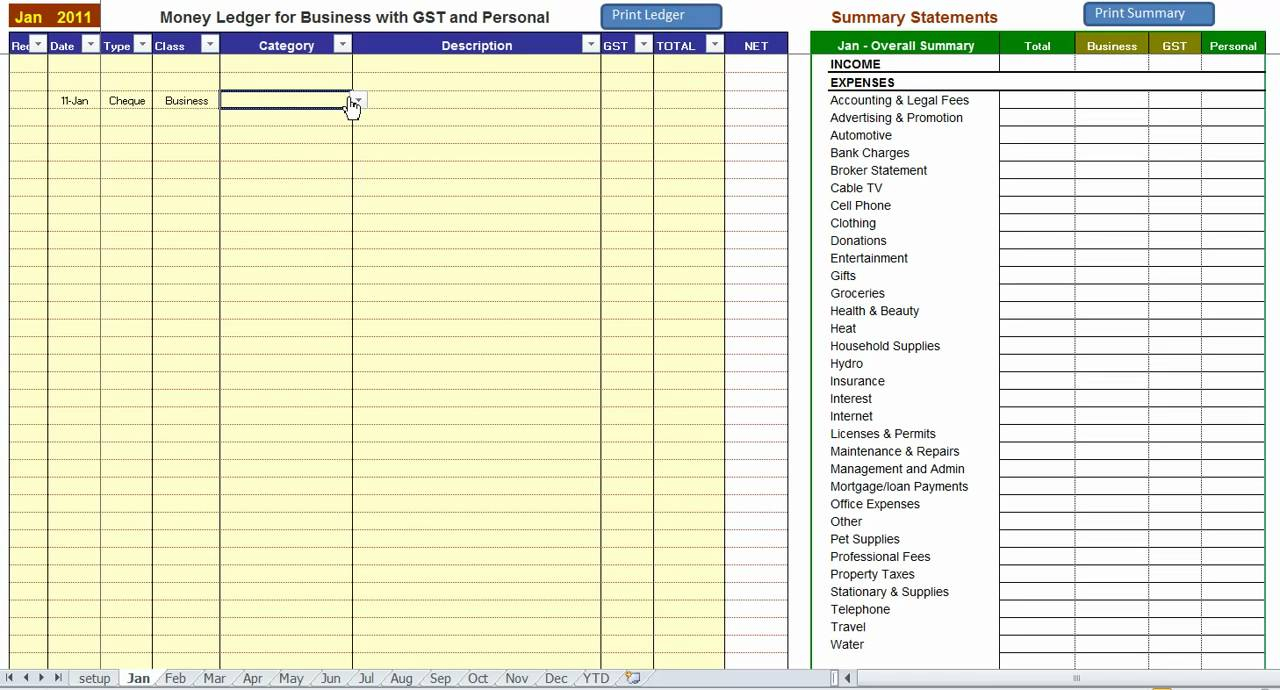

Spreadsheets typically work well for the following businesses: If you’re just starting out with your business or if you’re a sole proprietor, our Google Sheets bookkeeping template works really well. Who Should Use a Spreadsheet for Bookkeepingīecause spreadsheets are not purpose built for bookkeeping, they’re suited for smaller businesses or those that don’t need custom financial reporting.

This means you may only have annual financial data for your business and not monthly. Less Robust Reporting - Getting customized reports is a lot more difficult when using a spreadsheet compared to using bookkeeping software.That’s not ideal, but is ok for many businesses as you may just need to record A/R and A/P at the year-end to get ready to file your taxes. Cash Basis Bookkeeping - It’s more difficult to do accrual basis bookkeeping in a spreadsheet.Errors - Because spreadsheets are mostly manual entry, it’s easier to make errors than when using bookkeeping software like Xero.The main drawbacks of doing your bookkeeping in Excel or Google Sheets are: Copy and paste your bank transactions into the sheet and you’re 80% of the way done!ĭrawbacks of Bookkeeping in a Spreadsheet Save Time - Doing your bookkeeping in a spreadsheet can help you save time compared to learning a whole new software program.

As long as you have a reasonable template to use like ours, it’s not difficult at all.

0 kommentar(er)

0 kommentar(er)